5, DECEMBER, 2019

KUALA LUMPUR, MALAYSIA

SALARY INCREASE IN THE PHILIPPINES ACROSS INDUSTRIES SEEN AT 6% IN 2020

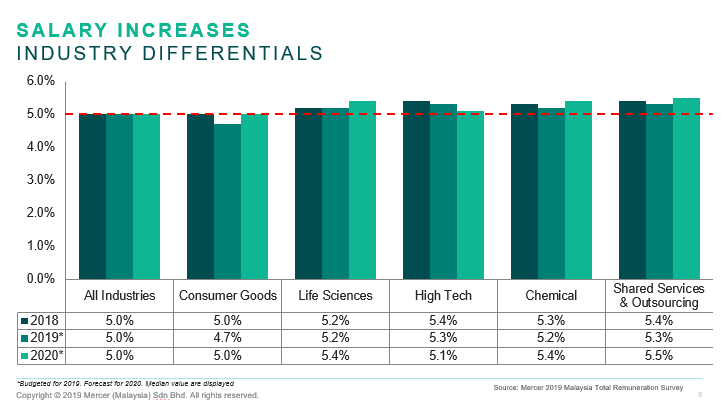

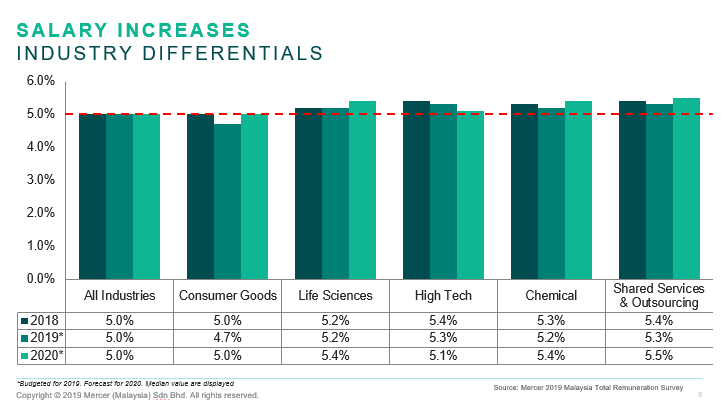

- Overall salary increase forecast for Malaysia remains stable at 5%

- Shared Services & Outsourcing industry is predicted to have the highest salary increase at 5.5% (compared to 5.3% in 2018) with consumer goods the lowest at 5%

- Voluntary turnover rate across all industries is at 6.5%, less than half of 2018’s 14.1%

KUALA LUMPUR, 5 December 2019 - Mercer today announced the results of its annual ‘2019 Malaysia Total Remuneration Survey,’ a study which identifies key remuneration trends and makes hiring and pay increase predictions for 2020. According to the findings, the 2020 salary increase across key industries is forecast to remain stable at 5% while the inflation rate is projected to increase to 2.4% (from 0.9% in 2019). The Shared Services & Outsourcing (SSO) industry is predicted to have the highest salary increase at 5.5% (compared to 5.3% in 2018), followed by Life Sciences (5.4%) and Chemical (5.4%) industries.

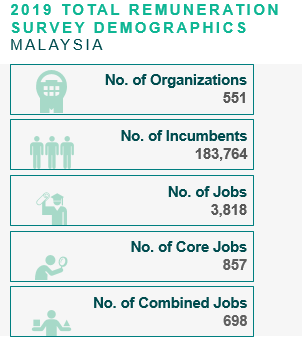

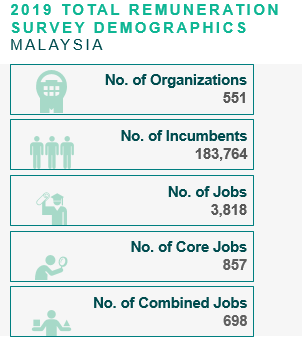

Figures and forecasts are based on the Total Remuneration Surveys - Mercer’s flagship annual compensation and benefits benchmarking study that identifies key remuneration trends and predicts hiring and salary increase, with participation increasing to 551 companies this year in Malaysia across various industries. In addition, Mercer also conducts regular pulse surveys throughout the year to keep up with the impact of the rapidly changing business environment and compensation and workforce trends.

The salary trend forecast for 2020 in Malaysia remains stable across job functions as well. The top three job functions with the highest salary increase are production and skilled trades (5.8%), Data Analytics/Warehousing (5.5%), and IT and project managers (5.3%). Administration and secretarial jobs are predicted to receive the lowest increment at 4%. As for career streams, paraprofessionals can expect salary increase of 5.3%, whereas executives can expect a 4% increase.

Prashant Chadha, Chief Executive Officer at Mercer Malaysia said, “Well-performing companies and industries may be more incentivized to provide employees with increases higher than the market average. It is no surprise we are seeing high salary increase forecast from industries including Shared Services & Outsourcing as they benefit from the government’s push for industry disruption and digitization. Similarly, high demand for some jobs may lead to larger salary increases to attract and retain talent. In today’s age of automation, besides just compensation, it is imperative for organizations to also focus on upskilling their workforce. The recent 2020 budget announcement by the Government to allocate funds for the development of a digital competent workforce will bring about positive.”

Across industries, the voluntary attrition rate was at 6.5% in the first half of 2019. The Consumer Goods industry in Malaysia came out with the highest voluntary turnover rate at 8.4%. In 2018, the same industry experienced the highest attrition rate of 15.3% due to the implementation of the Sales and Service Tax (SST) amongst other factors. The chemical industry, on the contrary, shows the lowest attrition rate of 4.1% in first half of 2019 and also has been forecasted with a high salary increment for 2020 of 5.4%, indicating healthy employee engagement and retention rates.

While the top reasons cited for employees leaving their organization in Asia varies by age group and gender, the top three reasons for employees leaving their organization are competitive pay, manager interaction, and a clear career path and job security. [Source: Mercer Asia Pulse Survey 1H 2019 and 2019 Global Talent Trends Study].

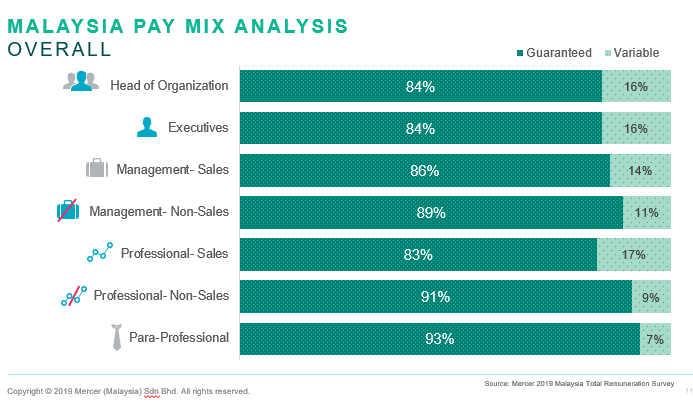

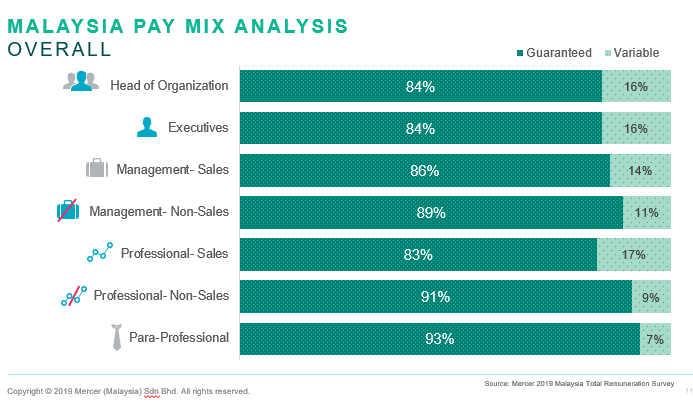

SHIFT TO AGILE REWARDS

As new roles are created and existing roles change with automation and AI, it is becoming more difficult to keep up with employee pay expectations and market values. According to Mercer’s 2019 Global Talent Trends Study, the number 1 workforce rewards priority is offering more diverse rewards. The good news is that HR’s priorities reflect what employees are asking for, both HR and employees agree that offering a wider variety of incentives and differentiating rewards for high performers will make a difference. To truly align to the business, investments in rewards should reflect a company’s strategic focus. In many cases, this means taking a step away from market norms and moving towards more differentiated offerings to satisfy both changing employee needs and the demand for new skills. Leading firms are focusing on the overall pay experience and expanding the focus beyond base pay to include career growth, incentives, and recognition.

Puneet Swani, Senior Partner and Career Business Leader for the International Region at Mercer said, “As the pace of change accelerates and we enter into this new world of work, companies should rethink how they can be future fit by putting their people at the heart of the change. Whether embracing digitalization, building competencies and skills needed for future competitive advantage or creating the right work environment and culture, changing the way organizations invest in their employees will yield a greater return for the business far into the future.”

For more data and insights from the Malaysia 2019 Total Remuneration Survey please see here.

About Mercer

Mercer delivers advice and technology-driven solutions that help organizations meet the health, wealth and career needs of a changing workforce. Mercer’s more than 25,000 employees are based in 44 countries and the firm operates in over 130 countries. Mercer is a business of Marsh & McLennan Companies (NYSE: MMC), the world’s leading professional services firm in the areas of risk, strategy and people with 76,000 colleagues and annualized revenue approaching $17 billion. Through its market-leading businesses including Marsh, Guy Carpenter and Oliver Wyman, Marsh & McLennan helps clients navigate an increasingly dynamic and complex environment. For more information, visit www.asean.mercer.com. Follow Mercer on Twitter @Mercer.

Reference Sources:

- IMA Asia, Asia Pacific Executive Brief, October 2019

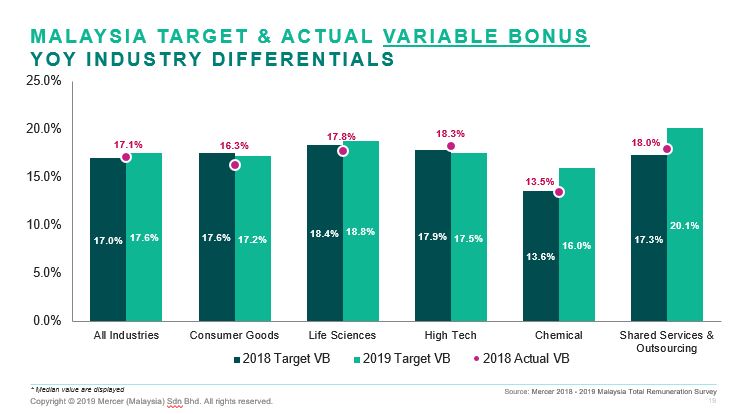

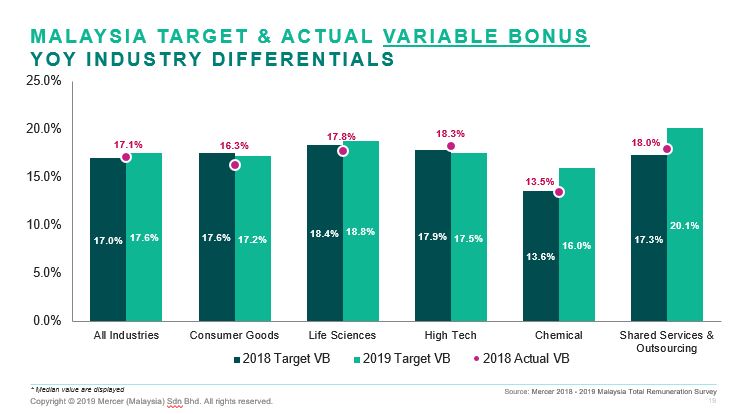

Figure 1

Figure 2

Figure 3

Figure 4