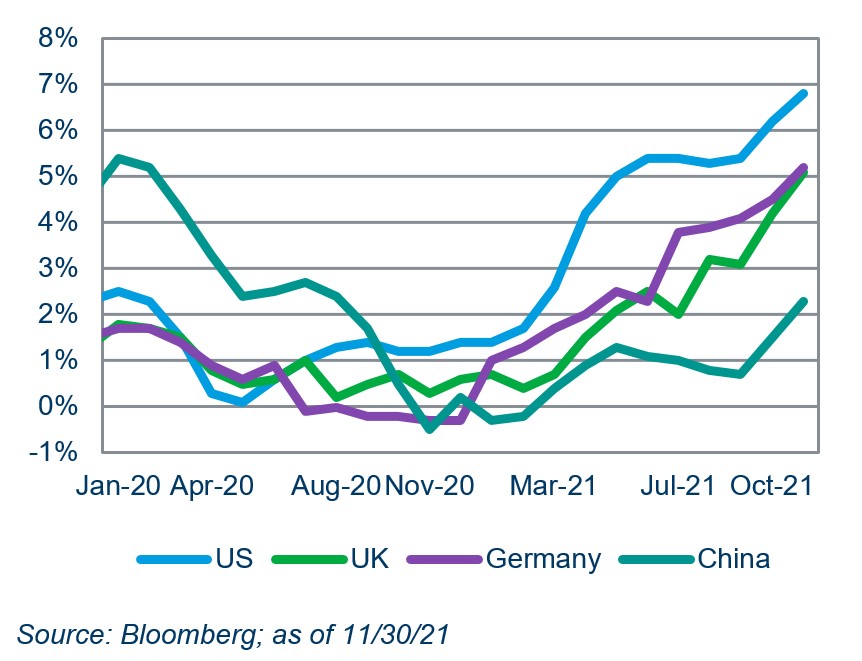

Economic data indicated that the recovery remained well on track with forward-looking purchasing manager indices still in expansion territory, although gradually receding from their recovery peaks. Inflation remained high, prompting major central banks to further accelerate their exit strategies from expansive monetary policies. The Federal Reserve announced a doubling in the pace of its tapering from January 2022, while the Bank of England and a few other central banks in continental Europe increased short-dated rates.

The US avoided a year-end fiscal cliff after Congress voted to extend the debt ceiling beyond next year’s mid-term elections. However, Biden’s Build Back Better plan got stuck in the Senate as moderate Democrats push for a more modest bill amid concerns about inflation and overall debt levels.

10-year yields in most major regions ended the month only moderately higher, but yields rose significantly at the shorter end of the curve for both the US and UK as markets priced in a faster pace of monetary tightening. Both yield curves flattened as a consequence, reflecting concerns that central banks may move too fast next year. Investment grade credit spreads hardly changed, but high yield spreads declined considerably, recovering from the high yield sell-off in late November.

Geopolitical events did not appear to have an impact on broad markets but reminded investors of short term tail risks from politics. NATO and Russia continued to face off over Ukraine, most western countries announced diplomatic boycotts of China’s Winter Olympics. The election of a leftwing candidate in Chile led to a collapse in its stock markets, while the self-inflicted collapse of the Turkish Lira intensified after its politicized central bank cut rates further.

Energy prices recovered with oil rising by almost 14% after last month’s sell-off as fears from the Covid-19 variant receded. Other commodities also recovered as investors became more optimistic on the continuation of the ongoing economic rebound.

The US dollar weakened over the month against major developed and emerging market currencies as demand for safe haven assets remained limited in this risk on environment which benefited more cyclical currencies from commodity producers.

Mercer's Monthly Market Monitor provides an overview of global financial markets.

In this issue we cover:

- Monetary policy and Covid-19 moved markets

- Equity markets finish 2021 optimistically, near all-time highs

- Short end of yield curves react to accelerated tightening

- Commodities recover as optimism returns, US dollar weakens

- 2021 in Review

- Market update