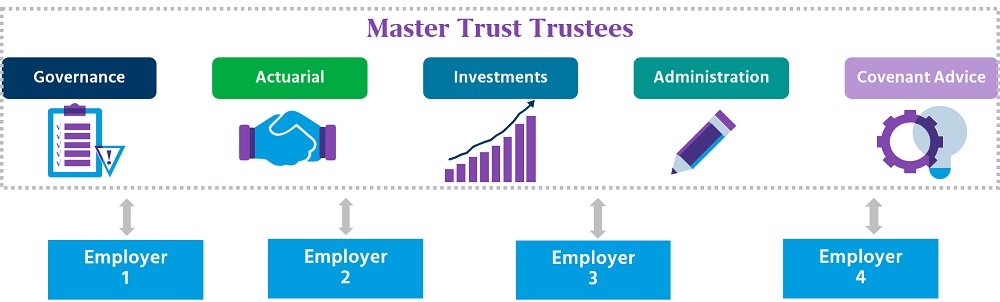

Under the Mercer DB Master Trust, Mercer will take on the legal responsibility for all aspects of running the pension scheme and provide all services, including investment with fiduciary management, journey planning, actuarial services, covenant assessment, scheme management and administration. Existing trustee roles will no longer be required as trusteeship will be provided by the independent professional trustees of the Mercer DB Master Trust.

WHY A DB MASTER TRUST?

A DB Master Trust solution can cut out complexity and deliver efficienciesin particular when dealing with any changes in regulatory requirements. This can lead to better outcomes for your sponsor and members - with less hassle for everyone concerned.

You should expect the right solution to:

- provide quality and consistency of governance and provide your sponsor with a more effective route to your endgame.

- improve value via economies of scale and lead to an overall long-term reduction in fees

- give you more time to concentrate on strategy and reducing the longer term risk while the DB Master Trust manages the day to day operations of the scheme

WHY THE MERCER DB MASTER TRUST?

The Mercer DB Master Trust combines the experience of a long standing Master Trust with the fresh thinking of our experts, and the significant buying power we can bring, to deliver a solution that is truly market leading.

HISTORY

The Mercer DB Master Trust has evolved from the Federated Pension Plan (FPP), an existing and long established Master Trust that currently has c. £260m of assets and 73 participating employers. Traditionally, the FPP focused on public sector outsourcing arrangements and is one of only a limited number of Master Trusts with a passport from the Government Actuary’s Department confirming that it can provide broadly comparable pension benefits to the public sector.

By building on the strong base of the FPP and adding the scale offered by Mercer, it provides an excellent solution for private sector clients looking to manage legacy DB liabilities.

As part of strengthening the offering, we are delighted to announce the appointment of Independent Trustee Services and PTL as additional professional trustees to work alongside PAN Trustees who has been the Trustee of the FPP for over 15 years.

Making the move

A move to Master Trust creates risks and opportunities. We have an effective transition plan and an experienced team that will mitigate any risks and use the move as an ideal opportunity to position the scheme for the future and at the same time enhance the member experience.