As part of the 2016 Federal Budget changes, taking effect from 1 July 2017, a cap of $1.6 million will be enforced on superannuation savings that can be transferred from a concessionally taxed ‘accumulation account’ to a tax-free ‘retirement account’. According to Richard Starkey, Consulting Actuary, Retirement income modelling and apps at Mercer, this can have a significant impact on superannuation strategy.

“As this super reform takes effect as at 1 July 2017, it is important that individuals review their superannuation strategy, to give their superannuation the best chance to enjoy tax-free earnings,” said Mr Starkey.

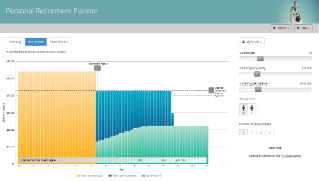

Mercer’s Retirement Income Simulator is the first of its kind that builds in the impact of this transfer balance cap.

Mr Starkey added, “It allows individuals to model their superannuation comprehensively and ascertain if they are likely to exceed the transfer balance cap. Individuals can then determine a strategy that will give them the best financial outcome.”

The transfer balance cap is the most complicated change to super legislation for many years as it affects both the pre- and post-retirement phases. Mercer’s Retirement Income Simulator takes the burden off individuals and super funds.

“There are a number of online calculators available to the public but they do not include the level of assurance that the Mercer calculator offers in relation to factoring in current legislation. Additionally the calculator offers additional features such as multiple retirement scenarios, career change and career break features, investment return simulations and lump sum drawdowns at and during retirement,” said Mr Starkey.