At last a Budget with minimal changes to superannuation

The 2022/23 Budget only includes one widely applicable change to superannuation - an extension of pension minimum drawdown relief (see below for details). This year of respite will be welcomed by an industry still struggling to digest a long and complex pipeline of changes implemented in recent years while also preparing for previously announced initiatives taking effect over the next couple of years (as outlined below).

The lack of change also supports the Government’s desired positioning ahead of the election as the party that can be trusted not to meddle with the superannuation system – in particular, ruling out any adverse tax changes such as some of the policies that Labor took to the previous election.

But is it a missed opportunity?

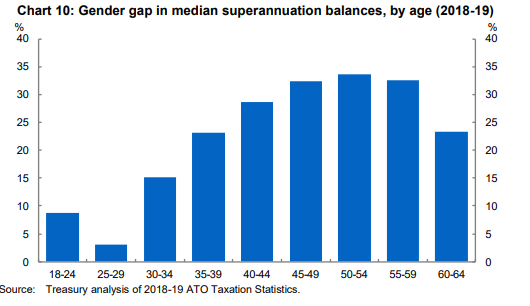

While some stability is welcome, there are some changes Mercer would like to have seen – in particular some concrete measures to work at reducing the gender super gap and to improve the fairness of the super tax concessions regime – see our feature article: Gender superannuation savings gap – she’ll be right?

2022/23 Budget change - Extension of pension drawdown relief

The Budget includes a further 12-month extension of the COVID-19 temporary relief under which the minimum superannuation pension drawdown rates have been halved for the three years to 30 June 2022.

As part of its response to the coronavirus pandemic in early 2020, the Government reduced the superannuation minimum drawdown rates by 50% for the 2019‑20 and 2020‑21 income years. Last year the Government extended the reduction to 2021-22 and it has now undertaken to provide a further 12 months extension, until 30 June 2023.

The minimum drawdown requirements determine the minimum amount of a pension that a retiree has to draw from their superannuation in order to qualify for tax concessions. The Budget papers indicate that the extension recognises the continuing volatility of financial markets and will allow retirees to avoid selling assets in order to satisfy the minimum drawdown requirement.